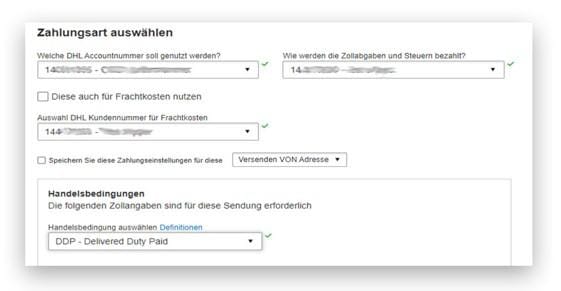

Service Duty Tax Paid

| Place of Billing | Billing Method | Costs | Payer |

|---|---|---|---|

| Country of departure or third country |

DHL Express Account |

Transport costs & duties/taxes | Shipper or third party |

Service Duty Tax Processing

| Place of Billing | Billing Method | Costs | Payer |

|---|---|---|---|

| Country of Destination | DHL Express Account * | Duties/taxes | Recipient |

| Country of Destination | DHL Express Account * | Transport costs & duties/taxes | Recipient |

| Country of Destination | DHL Express Account * | Duties/taxes | Third party |

| Country of Destination |

Cash/Creditcard/PayPal |

Duties/taxes | Recipient |

* Elimination or reduction of the costs for Duty Billing Services:

- If the payer of the import duties has their own deferment account, the costs for the Duty Tax Processing service are waived.

-

If the payer of the import duties has issued a SEPA mandate, only 50% of the costs for the Duty Tax Processing service are incurred.

Jan 2025, subject to change