Perfect data and complete customs documents ensure that your international shipments pass customs smoothly and reach their recipients on time.

YOUR ADVANTAGES

- Acceleration of customs clearance: If all data and customs documents are complete and correct, nothing stands in the way of smooth customs clearance.

- Save time and resources: Queries about missing data by customs authorities or DHL Express can be avoided

- On time delivery: Perfect data ensures that your shipment reaches its recipient express without delays

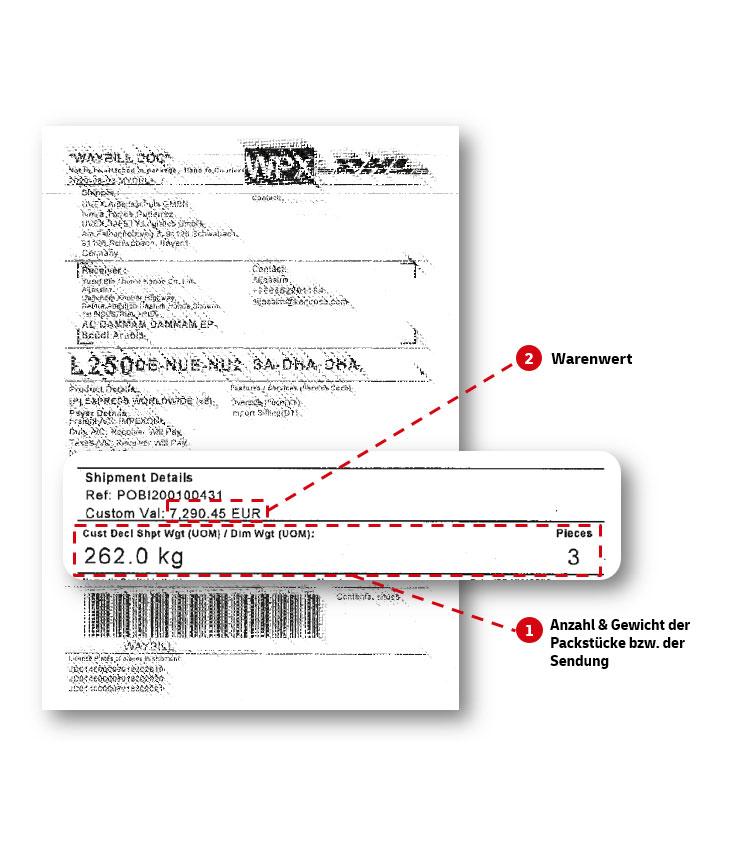

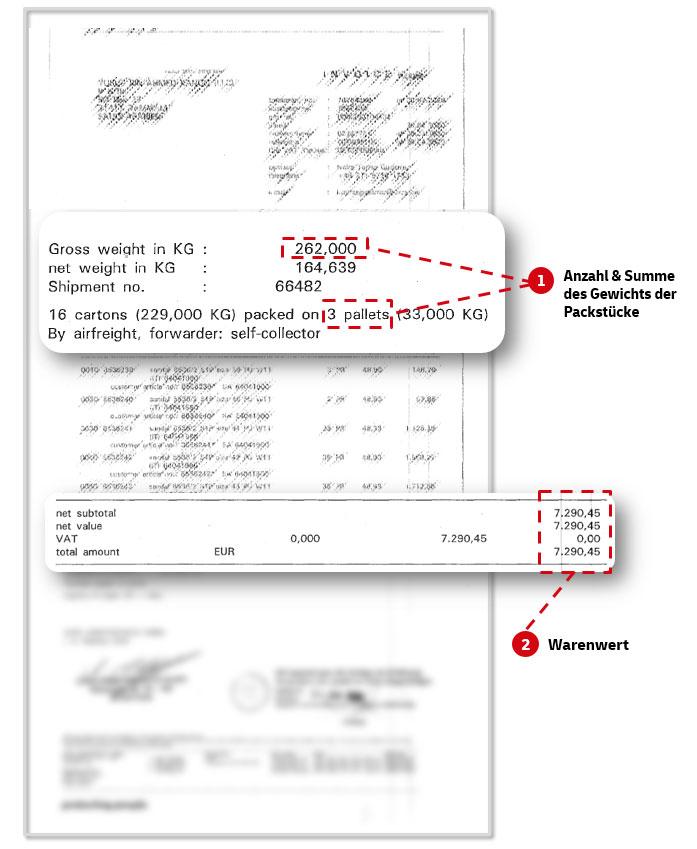

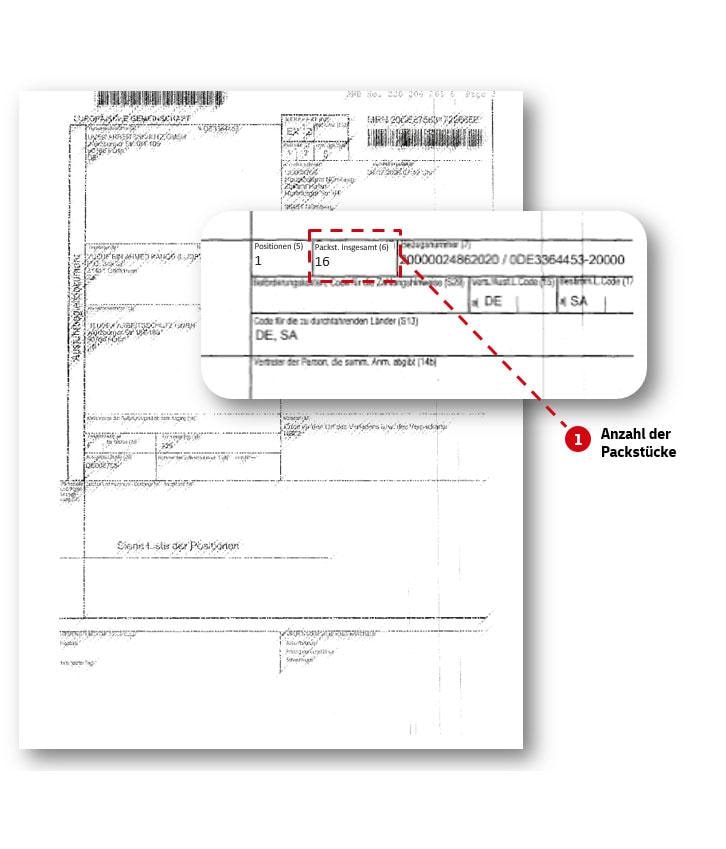

Matching information on shipping label and customs documents

Only if the digital customs data, which also appear on the shipping label, as well as the information on the customs documents (export accompanying document ABD, commercial/proforma invoice, etc.) are complete and match, your express shipment can be cleared without delay.

Shipping label

Commercial & Pro Forma invoice

Export accompanying document

Correct goods and content descriptions

A correct and acceptable content description shows which goods are involved, what they are made of and for what purpose they will be used. Goods descriptions need to be accurate so that customs authorities can identify prohibited or restricted goods and establish an appropriate risk profile for security purposes.

Examples of unacceptable and acceptable goods descriptions

Required customs documents

Which customs accompanying documents must be part of your consignment depends on several factors: Value of goods, country of destination, reason for shipment, purpose of use and much more.

Documents, free sample goods or goods that are not intended for resale?

| Value of goods | up to EUR 1,000 | over EUR 1,000 |

|---|---|---|

| Required documents* |

|

|

Goods intended for resale?

| Value of goods | up to EUR 1,000 | over EUR 1,000 |

|---|---|---|

Required documents*

|

|

|

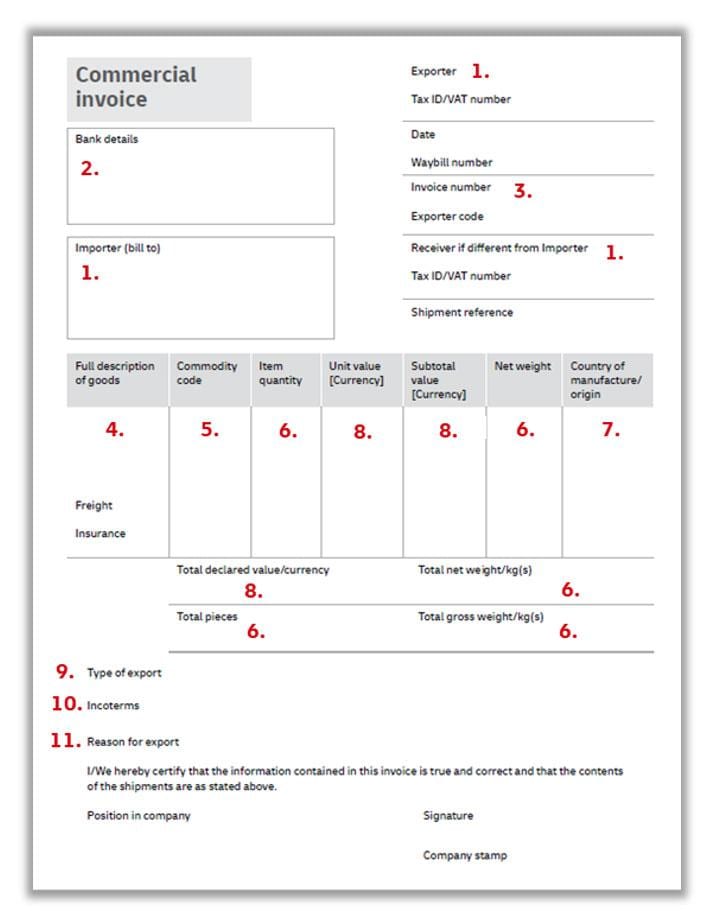

The perfect commercial & Pro Forma invoice

A commercial invoice or proforma invoice is required for all shipments outside the EU. There are some mandatory details for this, but the more exact additional details are provided, the more helpful this is for customs clearance. All details contribute to facilitating and speeding up the processing of the consignment during import.

1. Exporter/Shipper, Importer/Receiver

2. Bank Details

3. Invoice Number & Date

4. Goods and Content Description

5. Goods/HS Code

6. Quantity and Weight

7. Country of Origin

8. Values of the individual items and total declared value

9. Export Type

10. Incoterms

11. Reason for Export